How blockchain and cryptocurrencies can help build a greener future

The energy that powers Bitcoin mining is already as much as 78% renewable Image: Rebcenter-Moscow on Pixabay

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Blockchain

- The cryptocurrency ecosystem is shifting towards a cleaner, greener future.

- Most energy used to mine crypto already comes from renewable sources.

- Rather than harm the planet, crypto and blockchain can actually be a force for environmental good.

As with the feverish debate around Bitcoin and its carbon footprint, there has been no shortage of discussion surrounding cryptocurrencies and the energy they consume.

But this back and forth around crypto’s environmental impact is missing a glaring point. It is important to recognize that crypto is still in its very early stages, not dissimilar to where the internet was in 2002. The entire space is going through its Amazon moment. The first decade of this cryptocurrency experiment has grown far beyond anybody’s wildest expectations. At the same time, it has allowed those of us in the industry to identify what works and what doesn’t.

For example, the proof-of-work consensus algorithms (the mathematical problems that Bitcoin miners must solve) that power the Bitcoin network do indeed require a lot of energy. But what these arguments about Bitcoin’s environmental impact obscure is that the broader crypto ecosystem is in the midst of a shift towards a cleaner, greener, more sustainable future that will result in significantly lower carbon emissions.

This can be seen with the launch of Ethereum 2.0 and the move from a proof of work (PoW) consensus to a proof of stake model (PoS). PoW refers to the decentralized system that powers the Bitcoin network, with the model requiring huge amounts of energy to validate transactions and mint new tokens. But PoS allows miners to mine and validate block transactions based on the amount of coins that they hold.

Because PoS demands significantly lower hardware requirements than PoW, the energy needed to facilitate secure transactions will only continue to fall in the future. Some forecasting models show that Ethereum 2.0’s PoS model will be 99% more energy efficient than PoW models.

We are already seeing the results of what we can expect from PoS, with the Ethereum network consuming almost 100 Twh less than the Bitcoin network. Ethereum is hardly alone in this consensus revolution, with ascendant, next-generation blockchains like Cardano, Polkadot, EOS and Cosmos each implementing their own versions of PoS.

But even if we put aside these developments and focus strictly on the assertion that crypto is a threat to the planet, it is important to distinguish the sources of energy that crypto miners use, with data indicating that most of the electricity used for crypto mining comes from renewable sources.

Research from the University of Cambridge shows that the renewable share of these energy mining pools is as high as 78%. Although there are exceptions depending upon which region of the world you’re focusing on, hydroelectric power, in particular, is rapidly emerging as the de facto power source for crypto-mining operations.

Another factor to consider is that crypto miners are increasingly using excess electricity that would otherwise go to waste. The emergence of crypto mining farms has soaked up extra capacity and prevented the waste of unused renewable energy.

It is also important to note that the traditional international financial system requires significantly more energy than the Bitcoin network. All of the disparate parts that make up the whole of the global banking network – banking data centres, card network data centres, ATMs and bank branches – use a lot of energy. In fact, the traditional financial sector provides financing for some of the most environmentally damaging projects on Earth.

If we’re really looking for an ecologically destructive force, we should focus on gold mining. After all, this is an industrial sector that is heavily dependent upon fossil fuels. Even the industry’s main lobbying arm, the World Gold Council, has acknowledged the metal’s huge carbon footprint, highlighting in a recent report that the industry's emissions need to fall by 80% over the next 30 years in order to meet the Paris Climate Agreement targets.

So if we acknowledge that traditional finance and mining account for a significantly larger share of greenhouse gas emissions than crypto, the question we should be asking ourselves is how crypto and blockchain can actually lead the way and become a positive, transformative force for the energy sector, slashing operating costs and opening up a new window of transparency.

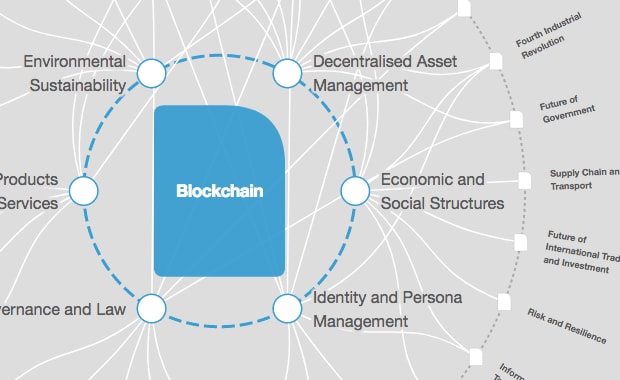

Use cases are not hard to find. Blockchain projects have already been deployed in a range of different fields, from wholesale electricity distribution and peer-to-peer energy trading to electricity data management and commodity trading.

One area that is particularly ripe for disruption is the global supply chain, in particualr the energy sector. Amidst this transition between polluting fossil fuels and a clean, renewable future, we should be looking for ways to mitigate and streamline the processes involved in extracting and transporting energy. Blockchain provides us with a platform that provides real time speed and efficiency, not to mention traceability and transparency.

What is the World Economic Forum doing about blockchain in supply chains?

We’re seeing this unfold in the real world. Major Indian steel conglomerate Tata Steel is partnering with HSBC to experiment with smart contracts on the blockchain, exporting raw materials around the globe while cutting contract settlement times from a matter of weeks to a matter of days. Imagine all of the energy saved in the process.

Meanwhile, the Carbon Utility Token (CUT) is an example of a growing class of green assets designed in large part to help corporations manage their carbon allowances. The sale of each CUT token goes towards investments in carbon capture and carbon offsetting programs, representing a tangible step towards carbon neutrality in the crypto ecosystem. As more and more corporations begin to add Bitcoin and other cryptocurrencies to their balance sheets, it’s good to know that CUT provides an avenue to completely offset the carbon footprint behind each coin.

While there are certainly challenges ahead, crypto and blockchain have the potential to lead us towards a much greener planet, with the discussion surrounding crypto and energy stimulating us to hasten our transition to clean energy sources while providing us with the tools to do so.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on BlockchainSee all

Scott Doughman

December 5, 2023

Shawn Dej and Sandra Waliczek

October 19, 2023

Scott Doughman

September 22, 2023