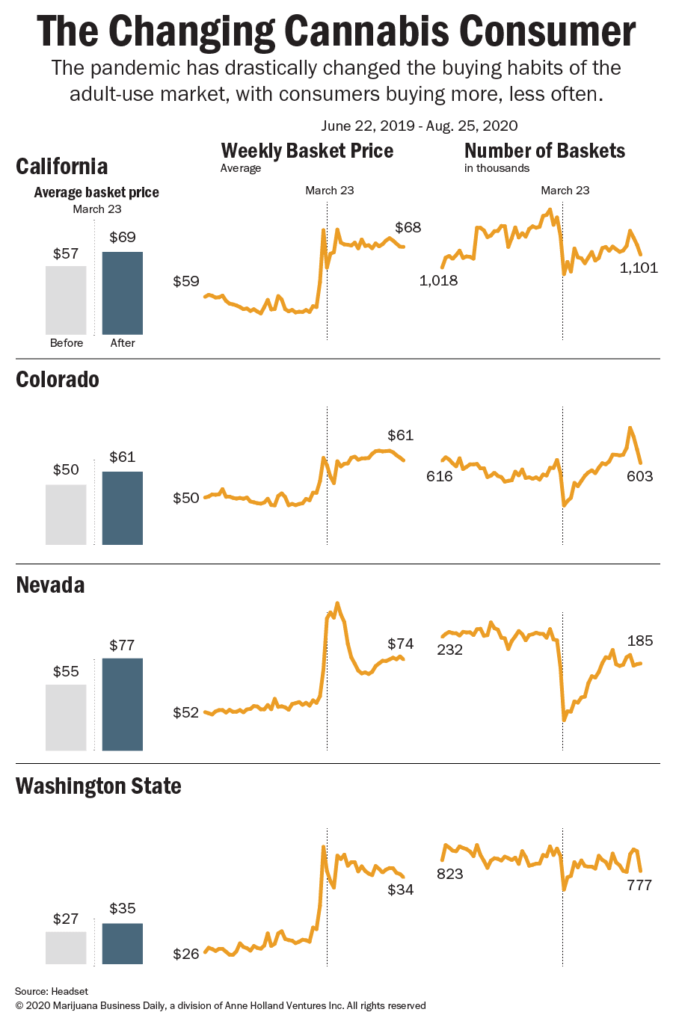

Consumers’ purchasing patterns involving marijuana have changed noticeably over the past several months in response to the coronavirus crisis.

Marijuana shoppers are spending more money per visit to recreational retail outlets. But they are shopping less often, perhaps for safety, or scheduling, reasons.

Across the country, in fact, many states declared cannabis companies “essential” businesses.

But there have been roller-coaster weeks in adult-use sales in California, Colorado, Nevada and Washington state, according to data provided by Seattle-based analytics firm Headset.

The initial state lockdowns and shelter-in-place orders caused recreational sales to drop almost 50% in late March in the four states – at least until federal stimulus checks started hitting consumers’ bank accounts in April and sales rebounded.

In the past month, however, a downturn in weekly sales has started to emerge. But it is too early to understand the exact cause.

One possibility: The U.S. government’s temporary lifeline to tens of millions of unemployed workers – $600 a week in extra jobless benefits – expired at the end of July.

But up until now, cannabis sales have been relatively recession-resistant.

The National Bureau of Economic Research formally proclaimed the recession began in February, when the coronavirus crisis caused much of the U.S. economy to pause.

Recession or not, marijuana shopping habits have changed markedly since March because of the COVID-19 pandemic, as shown by this chart:

The average amount a consumer purchases at one time – or the average basket size – has increased in California, Colorado, Nevada and Washington state, while at the same time, the number of shopping trips, or baskets, per week have declined.

For example, Nevada’s average basket size jumped $22 after March 23, from $55 to $77.

California and Colorado experienced increases of $10 or more, while Washington state consumers boosted their average purchases by close to $8.

Meanwhile, the number of baskets purchased per week has started to improve since the record lows recorded in March.

Colorado recorded an estimated 362,000 baskets for the week of March 23, the lowest of the year.

That figure has since recovered to 603,000 baskets at the end of August, just shy of the 613,000 recorded at the first of the year.

California, Nevada and Washington state recorded similar buying patterns.

Other mainstream industries report comparable trends as consumers adjust to pandemic shopping.

A survey of grocery shoppers conducted by the Food Industry Association found that 78% of customers changed where they shop, with 40% shopping at fewer stores and 44% spending more money per visit.

While the markets aren’t exactly comparable, the question for cannabis retailers is: Will be is this a temporary, pandemic-induced trend, or have consumers changed their shopping patterns for good?

Andrew Long can be reached at andrew.long@mjbizdaily.com