The good people at the International Consortium of Investigative Journalists, the group that spelunks through the deepest, darkest, and rankest caverns of global finance and brings light to the twisted creatures who thrive therein, has some kind words for the U.S. Congress, which apparently has taken steps to solve a serious problem that I did not know even existed.

Lawmakers in the United States say they have taken a significant step closer to enacting a major anti-money laundering reform that would make it more difficult to move dirty money through U.S. firms. Late last week, Democrats in the House and Senate announced that they had included provisions targeting anonymous shell companies into a must-pass national defense spending bill. The move is significant because, unlike many pieces of legislation that languish in Congress, the omnibus bill is often approved on a bipartisan basis to continue funding national defense.

Wait. American companies laundering money for international thieves and mobsters? Unpossible!

A prevalence of anonymous shell companies makes laundering and moving money derived from corruption or other criminal activity easier, and makes the lives of compliance officials and law enforcement harder. This was underscored in ICIJ’s recent FinCEN Files investigation, a global collaboration involving more than 100 media partners around the world examining torrents of suspicious money flowing through major banks. The project was based on leaked U.S. Treasury Department documents detailing more than two trillion dollars flowing through the U.S. financial system. The records showed bank compliance officers searching in vain to determine who was behind shell companies moving massive amounts of money through their firms’ accounts.

Wait for it.

In recent years, the United States has become a prominent destination for tainted money, largely because it has some of the world’s best options for those wanting to cloak their activity behind highly secretive shell companies. The Tax Justice Network, an advocacy group, ranks the United States as the second most secretive jurisdiction on earth, second only to the Cayman Islands, and beating even places like Switzerland that are known for intense banking secrecy. Often owned by opaque LLCs, luxury real estate in posh locations like New York and Miami now rival the classic secretive Swiss bank account for rich customers aiming to hide money.

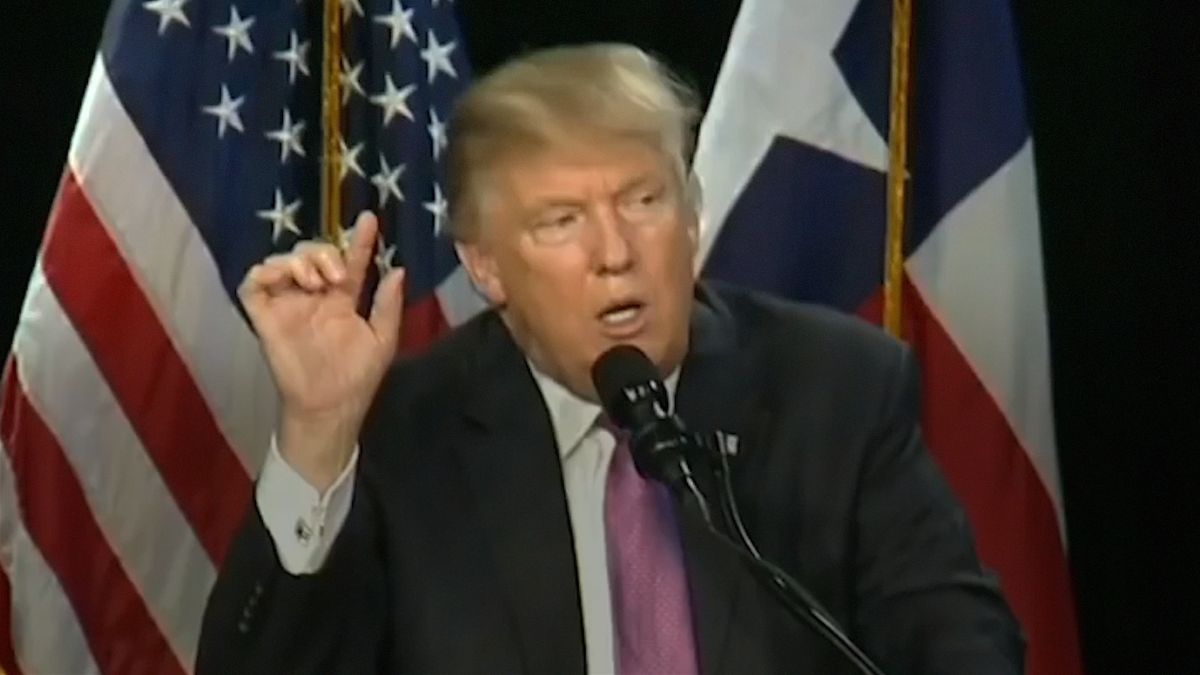

Luxury real estate, you say? In New York and Florida, you say? Hmmm, provocative, n'est pas?

This new provision is embedded in the National Defense Authorization Act, which the president* is currently saying he will not sign. The public reason for this is that he wants military bases named after Confederate traitors to remain named after Confederate traitors. This is rancid enough. However, the inclusion of anti-laundering provisions such as this one—which has bipartisan support that runs from Senator Mark Warner to Senator Tom Cotton, who is not being a bobble-throated slapstick on this issue—makes one wonder what the president*'s real problem with this year's NDAA is. It would be wise to keep an eye on this if and when the president* ever gets around to signing or vetoing it, which depends vitally on his willingness to defend the country against something. There is much mischief that yet can be done.

Charles P Pierce is the author of four books, most recently Idiot America, and has been a working journalist since 1976. He lives near Boston and has three children.